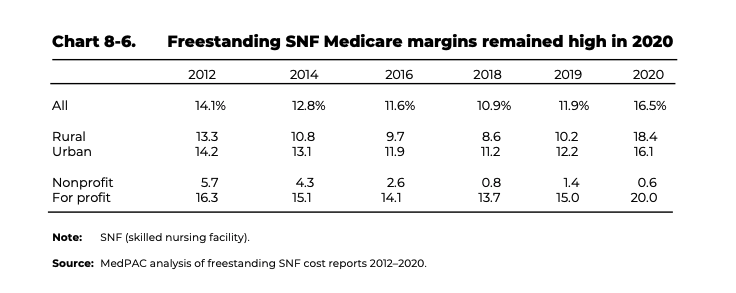

Medicare margins for all freestanding skilled nursing facilities across the United States varied widely in 2020, according to new data from the Medicare Payment Advisory Commission. While 25% reported margins of 28.7% or higher, another quarter were stuck with margins 4% or lower.

But the most concerning finding was that nonprofit SNFs had a Medicare margin of 0.6% and would have likely been in the negative had federal COVID-19 supplemental funding not been available, several experts told McKnight’s Wednesday.

“These not-for-profit providers are a vital part of the market and often fill needs that are not otherwise met. The lack of margins for not-for-profit SNFs should be concerning to everyone,” said Melissa Brown, chief operating officer of Gravity Healthcare Consulting. “Congress needs to act to save these invaluable providers, who often serve the underprivileged in our communities.”

The findings were featured in MedPAC’s annual Data Book on healthcare spending and the Medicare program. The advisory panel released the publication Tuesday.

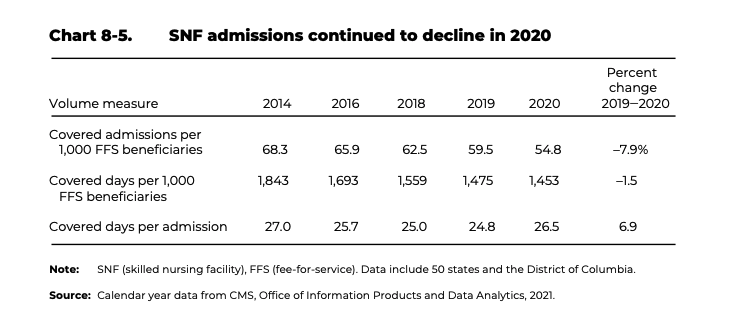

Data also revealed that SNF admissions per 1,000 fee-for-services beneficiaries continued to decline. They dropped 7.9%, from 59.5% to 54.8%, between 2019 and 2020. During the same period, covered days per admission declined at a slower 1.5% because stays were longer, the report found.

Although the aggregate Medicare margin for freestanding SNFs in 2020 exceeded 10% for its 21st consecutive year — coming in at 16.5% — for-profit SNFs’ margins were 20%, while non-profits’ were 0.6%.

“The overall margin for 2020 at 16.5% is also artificially inflated by government funds and we know that all providers are in even worse shape today than they were in 2020,” Brown told McKnight’s Long-Term Care News on Wednesday. “Costs have increased, inflation soared, and without supplemental funds many communities are operating at a negative margin today.”

Looking at 2020 Medicare margin alone is going to give a skewed overall perspective, noted Jennifer Leatherbarrow, RN, vice president of informatics at Complete Care Management LLC.

“The number of admission and types of admission were not typical due to the COVID-19 outbreak. We saw fewer elective surgeries during the height of COVID, and we saw an increase in skilling in place related to the [public health emergency,” she told McKnight’s Wednesday. “Just these two factors make it impossible to do an apples-to-apples comparison to previous years. We are starting to see an increase in admissions for short-term rehab and post hospital skilled care, but I think it is too soon to speculate where we will be in a years’ time.”

Shift to home health

The MedPAC report also showed that the total number of SNFs decreased by 0.5% between 2020 and 2021. Since 2017, the total number of SNFs have decreased by less than 1% annually.

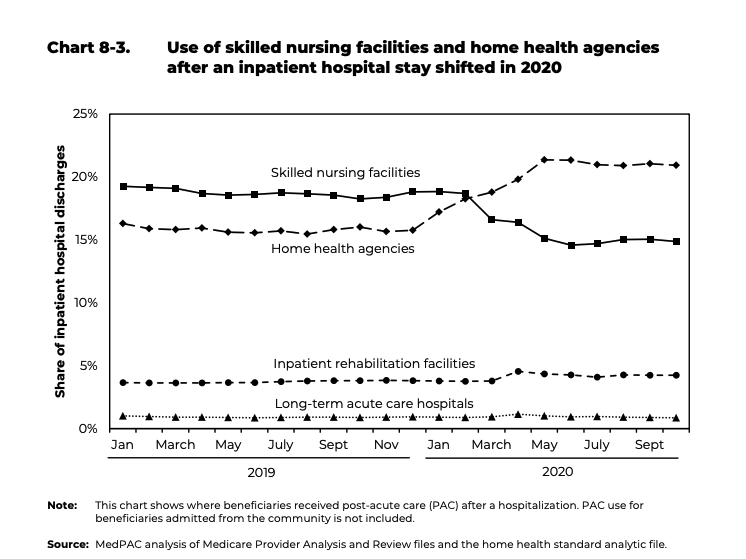

Additionally, home health emerged as the most common type of post-acute care setting used among Medicare beneficiaries after a hospital stay, surpassing skilled nursing facilities.

In 2019, SNF care was the most common type of post-acute care. It received 18.7% of inpatient discharges. Home health care was the second most frequent type of PAC, with 15.8% of inpatient discharges.

The positions flip-flopped in 2020, thanks in large part to the onset of the COVID-19 pandemic. The share of inpatient hospital discharges referred to SNFs declined to 16.6%; by October 2020, it was 14.9%. By contrast, the share receiving home health care services increased to 20.9%.

“The shift to home health care reflected the pandemic-related effects experienced by nursing homes and the reluctance of beneficiaries to use them. The share of inpatient hospital discharges referred to inpatient rehabilitation facilities also increased slightly in April 2020,” report authors wrote.

“COVID was a catalyst for what was already occurring (with the shift to more home health), and has sped up this timeline by 5-10 years. SNF and senior living providers should seriously consider diversifying into home health,” Brown said. For smaller agencies that have already started diversifying, she said now is the time to take market share and expand profitability through home health.

Brown added that SNF providers “should definitely be concerned.” Expanding into home health should be the goal of every senior living provider “in a big way,” she added.

“Home- and community-based services are the future of eldercare, and should be a strategic focus for any senior living provider,” Brown said. “The unfortunate, but likely end is that many SNFs are going to close. That will bring more opportunities for the SNFs that can manage to stay open, but there are some rough waters ahead until we see more stabilization and a right-sizing of the SNF business based on consumer demand.”

Leatherbarrow observed that the switch to home health “is not new information” and people in the industry have seen the shift coming for several years.

To address this trend, Complete Care is working with providers to develop comprehensive “hospital-at-home” and PACE programs. Leatherbarrow also acknowledged that might not be a feasible solution for everyone moving forward since nursing resources are currently stretched to their limits.

“SNF providers should continue to provide the best care possible and focus on improving outcomes,” Leatherbarrow said. “This will put them in a position to be preferred providers, increasing their referrals and giving them a positive community reputation.”